Introduction

Building strong business credit is one of the smartest moves an entrepreneur can make. Whether you’re launching a startup or managing an established company, solid business credit opens doors to funding, better supplier terms, and overall financial stability. Unlike personal credit, business credit reflects your company’s financial health, which can be crucial when seeking loans, partnerships, or even negotiating leases. In this guide, we’ll explore the best ways to build business credit, strategies that work in 2026, and tips to ensure your company remains in excellent financial standing.

Understand the Basics of Business Credit

Before diving into strategies, it’s important to understand what business credit is and why it matters. Business credit is a record of your company’s ability to manage debt and pay bills on time. Lenders, suppliers, and even some clients check your business credit score to assess risk. Unlike personal credit, business credit is tied to your business name, EIN (Employer Identification Number), and financial history.

A strong business credit profile allows you to access:

- Lower interest rates on loans and credit lines

- Higher credit limits from vendors and suppliers

- Better terms for renting office spaces or equipment

- Protection of personal assets by keeping business and personal finances separate

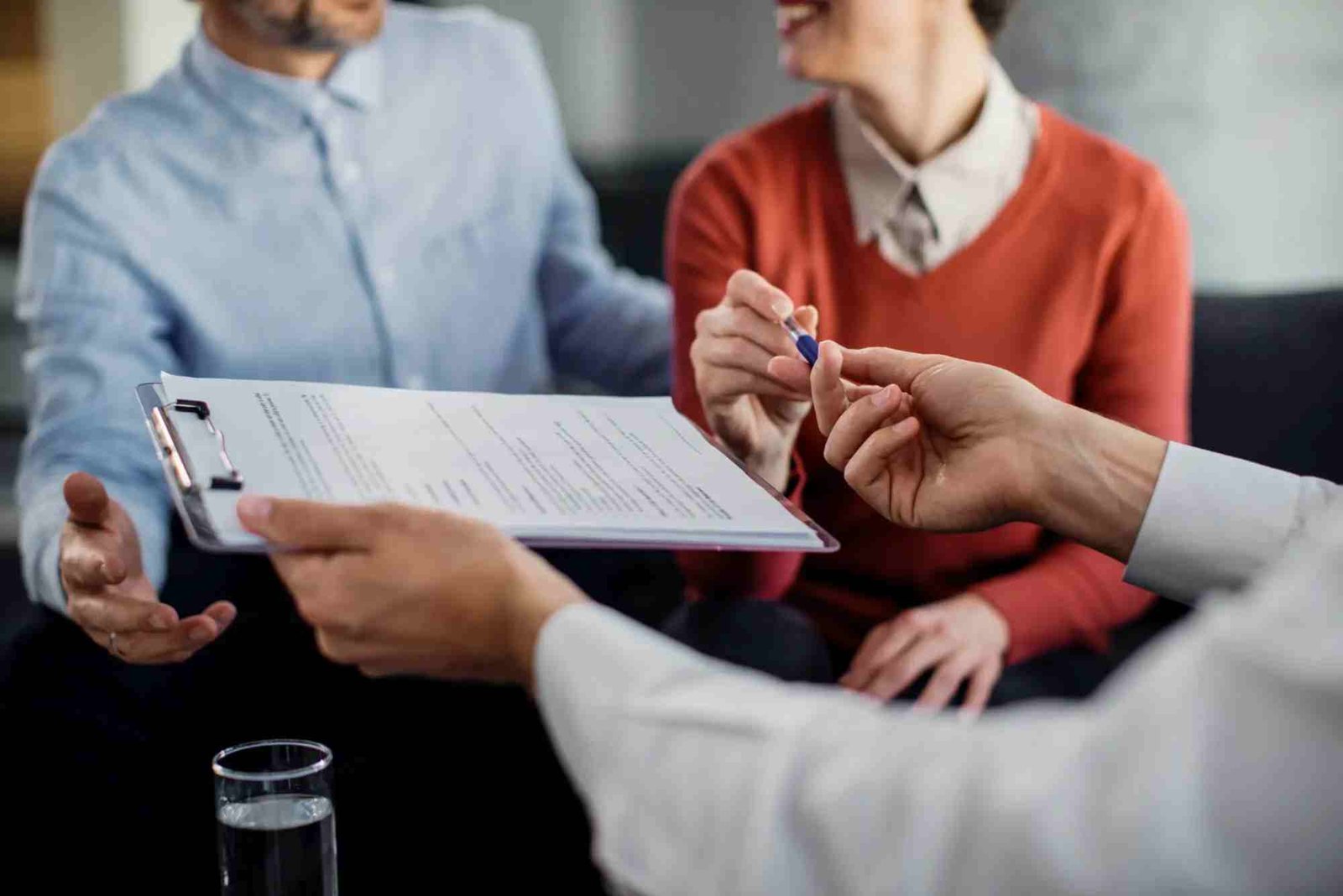

Establish Your Business Properly

A legitimate foundation is key to building business credit. Without proper registration, your business may not be recognized by credit bureaus.

Register Your Business Legally

Choose a legal structure, such as an LLC, corporation, or partnership. Each offers different advantages, but any registered entity is preferable over a sole proprietorship when building credit. Legal registration establishes your business as a separate entity, allowing you to build a distinct credit history.

Obtain an EIN

An Employer Identification Number functions like a Social Security number for your business. It is essential for opening bank accounts, applying for credit, and filing taxes. Most lenders require an EIN to report business credit activity accurately.

Open a Business Bank Account

A separate business bank account demonstrates financial responsibility. It helps distinguish personal and business expenses, which is critical for maintaining a clean credit profile. Regular transactions and consistent account activity show lenders that your business is financially active.

Use Vendor and Supplier Credit Wisely

One of the easiest ways to start building business credit is through vendor accounts that report to credit bureaus.

Work with Vendors That Report

Not all vendors report payments to business credit bureaus, so it’s important to choose suppliers who do. Net-30 accounts, for instance, allow you to pay invoices within 30 days while reporting on-time payments to credit agencies. Examples include office supply companies, wholesale distributors, and some service providers.

Pay On Time or Early

Payment history has a major impact on business credit scores. Timely payments reflect reliability and boost your credit standing. Some businesses even benefit from paying early, as it demonstrates financial strength and may improve your relationship with suppliers.

Apply for Business Credit Cards

Business credit cards are another effective tool for building credit. They allow you to separate personal and business expenses while establishing a track record of responsible credit use.

Choose Cards That Report

Select cards that report to major business credit bureaus such as Dun & Bradstreet, Experian Business, and Equifax Business. Not all business cards contribute to your business credit profile, so confirm this before applying.

Keep Balances Low

Using too much of your available credit can negatively impact your credit score. Aim to keep balances under 30% of your credit limit. This demonstrates responsible usage without signaling risk to lenders.

Make Timely Payments

Just like vendor accounts, your credit card payment history is crucial. Paying the full balance each month avoids interest and strengthens your credit profile over time.

Monitor Your Business Credit Reports

Tracking your progress helps identify areas for improvement and ensures accuracy.

Check Reports Regularly

Business credit reports from Dun & Bradstreet, Experian, and Equifax provide insights into your credit activity. Regular monitoring helps you catch errors, disputes inaccurate information, and stay on top of your score.

Correct Mistakes Immediately

Incorrect data can lower your credit score. If you notice discrepancies, contact the reporting agency promptly. Correcting errors ensures your credit history reflects your true financial behavior.

Diversify Your Credit Portfolio

A well-rounded credit profile demonstrates financial stability. Relying solely on one type of credit, such as a credit card, limits growth opportunities.

Explore Different Types of Credit

Consider a mix of:

- Business lines of credit

- Equipment financing

- Small business loans

- Vendor accounts

Each type of credit adds depth to your profile and shows lenders your ability to manage multiple financial obligations responsibly.

Maintain Good Relationships With Lenders

Strong relationships with banks and lenders can lead to favorable terms and higher credit limits. Transparency, regular communication, and consistent financial performance build trust and make future credit applications easier.

Keep Personal and Business Finances Separate

Blending personal and business finances can harm both credit profiles. Using personal funds for business purposes or vice versa can create confusion for lenders and complicate credit reporting.

Use Business Accounts Exclusively

Always pay business expenses from your business account. Avoid using personal credit cards for business transactions. Clear separation improves financial tracking and strengthens your business credit history.

Avoid Co-Signing

While tempting, co-signing with personal credit can expose your personal assets to business liabilities and may make it harder to establish independent business credit.

Build a Positive Payment History

Your payment history is the most influential factor in business credit scoring. Lenders want assurance that you can meet obligations consistently.

Pay All Bills on Time

From utilities to suppliers, ensure that all business bills are paid promptly. Late payments can quickly damage your credit score.

Negotiate Favorable Terms

Some vendors may allow you to negotiate net-45 or net-60 terms. Longer payment terms can help manage cash flow while still maintaining a positive record if paid on schedule.

Leverage Business Credit Reporting Services

Several services can help your business establish and maintain a strong credit profile.

Dun & Bradstreet

Obtaining a D-U-N-S number with Dun & Bradstreet allows you to start reporting your business activity. Many lenders use D&B scores as a benchmark for risk.

Experian Business and Equifax Business

Regularly updating and monitoring these reports ensures accuracy and allows your business to build credibility over time.

Plan for Long-Term Credit Growth

Building business credit is not a one-time effort. It requires consistent management, strategic borrowing, and careful monitoring.

Reinvest in Your Business

Using credit responsibly to fund growth demonstrates fiscal responsibility and may increase your borrowing potential in the future.

Maintain Low Debt Ratios

Keeping debt manageable relative to income and revenue helps maintain a strong credit score. Over-leveraging can raise risk and reduce access to additional credit.

Building business credit is a gradual process that requires planning, discipline, and strategic actions. By establishing a legal business entity, separating finances, using vendor accounts, responsibly managing credit cards, and monitoring your credit reports, your business can achieve a strong financial profile. Strong business credit opens opportunities for loans, partnerships, and growth while protecting personal assets. Start implementing these steps today to secure the financial future of your business.

FAQs

How long does it take to build business credit?

Typically, it takes 6–12 months of consistent, responsible credit activity to establish a solid business credit score.

Do I need personal credit to get business credit?

Initially, some lenders may consider your personal credit, but strong business credit eventually allows your company to secure financing independently.

Which business credit bureau is the most important?

Dun & Bradstreet, Experian Business, and Equifax Business are all significant. Different lenders may prioritize different reports.

Can I build business credit with just a small business?

Yes, even small businesses can establish credit by opening vendor accounts, using business credit cards, and paying bills on time.

Is separating personal and business finances necessary?

Absolutely. Mixing finances can confuse lenders, complicate accounting, and harm both personal and business credit profiles.