Introduction

Dubai is one of the world’s top real estate investment destinations, offering lucrative opportunities for investors and residents alike. Whether you are looking to buy a home or an investment property, securing a mortgage in Dubai is a common option. However, navigating the mortgage process can be complex, especially for expatriates and first-time buyers. This guide will provide you with a step-by-step approach to obtaining a mortgage for a property in Dubai, covering eligibility, requirements, types of mortgages, and more.

Understanding the Dubai Mortgage Market

The Dubai mortgage market is regulated by the UAE Central Bank, which has set specific rules to protect both lenders and borrowers. Banks and financial institutions offer various mortgage options based on factors such as income, property value, and residency status. real estate companies in UAE work closely with banks to facilitate mortgage approvals for buyers.

Eligibility Criteria for a Mortgage in Dubai

Before applying for a mortgage in Dubai, you need to ensure that you meet the eligibility criteria set by lenders. The key factors that determine your mortgage eligibility include:

Residency Status

- Both UAE nationals and expatriates can apply for a mortgage.

- Expatriates typically need to provide additional documentation compared to UAE nationals.

Minimum Salary Requirements

- The minimum salary required to qualify for a mortgage varies by bank, usually starting from AED 10,000 per month.

- Some banks may have a lower threshold, but a higher salary improves loan approval chances.

Age Limit

- Borrowers must be between 21 and 65 years old (or retirement age, whichever is lower) at the time of loan maturity.

Employment and Income Stability

- Lenders assess job stability and income consistency.

- Self-employed individuals must provide at least two years of business records.

Credit Score

- A good credit score is essential for mortgage approval.

- Borrowers with a poor credit history may face higher interest rates or loan rejections.

Types of Mortgages Available in Dubai

Dubai offers different types of mortgages based on interest rates and repayment structures. The most common types include:

Fixed-Rate Mortgage

- The interest rate remains constant for a specific period, usually 1-5 years.

- Offers stability in repayments, making it suitable for long-term planning.

Variable-Rate Mortgage

- The interest rate fluctuates based on market conditions and the Emirates Interbank Offered Rate (EIBOR).

- Suitable for those who can manage potential rate changes.

Islamic Mortgage

- Complies with Sharia law and does not involve interest.

- Works on a rent-to-own or profit-sharing basis.

Interest-Only Mortgage

- Borrowers pay only the interest for an initial period before repaying the principal.

- Suitable for investors looking to maximize cash flow.

How Much Can You Borrow?

The amount you can borrow depends on your income, down payment, and the lender’s policies. The UAE Central Bank has set loan-to-value (LTV) limits:

- For expatriates: Up to 80% for properties below AED 5 million; 70% for properties above AED 5 million.

- For UAE nationals: Up to 85% for properties below AED 5 million; 75% for properties above AED 5 million.

- For off-plan properties: Maximum of 50% financing.

Steps to Get a Mortgage in Dubai

Assess Your Financial Situation

- Determine your budget and calculate the down payment.

- Check your credit score and improve it if necessary.

Choose a Reputable Lender

- Compare mortgage rates from different banks and financial institutions.

- Consider working with a mortgage broker for better deals.

Get a Mortgage Pre-Approval

- Pre-approval helps determine your loan eligibility and budget.

- Provides a clear picture of your borrowing capacity.

Find Your Ideal Property

- Work with leading real estate companies in the UAE such as Emaar, Damac, Nakheel, and Sobha Realty.

- Ensure the property is approved by the lender.

Submit Your Mortgage Application

- Provide necessary documents including salary certificate, bank statements, passport, visa, and Emirates ID.

- Self-employed applicants must submit audited financial statements.

Property Valuation and Final Approval

- The lender will assess the property’s market value.

- Once approved, you will receive a final loan offer.

Sign the Mortgage Agreement

- Review the loan terms carefully.

- Sign the agreement and proceed with the property registration.

Transfer Ownership and Mortgage Registration

- Pay the required fees, including Dubai Land Department (DLD) charges.

- Register the mortgage with the DLD.

Fees and Costs Involved in Getting a Mortgage

Apart from the loan amount, there are several additional costs to consider:

- Down Payment: 20-30% of the property value.

- Mortgage Registration Fee: 0.25% of the loan amount, plus AED 290.

- Property Valuation Fee: AED 2,500 – AED 3,500.

- Processing Fee: 1% of the loan amount.

- Life and Property Insurance: Mandatory and varies by lender.

Best Real Estate Companies in UAE to Assist with Mortgages

Many top real estate companies in UAE offer assistance in securing mortgages. Some of the leading companies include:

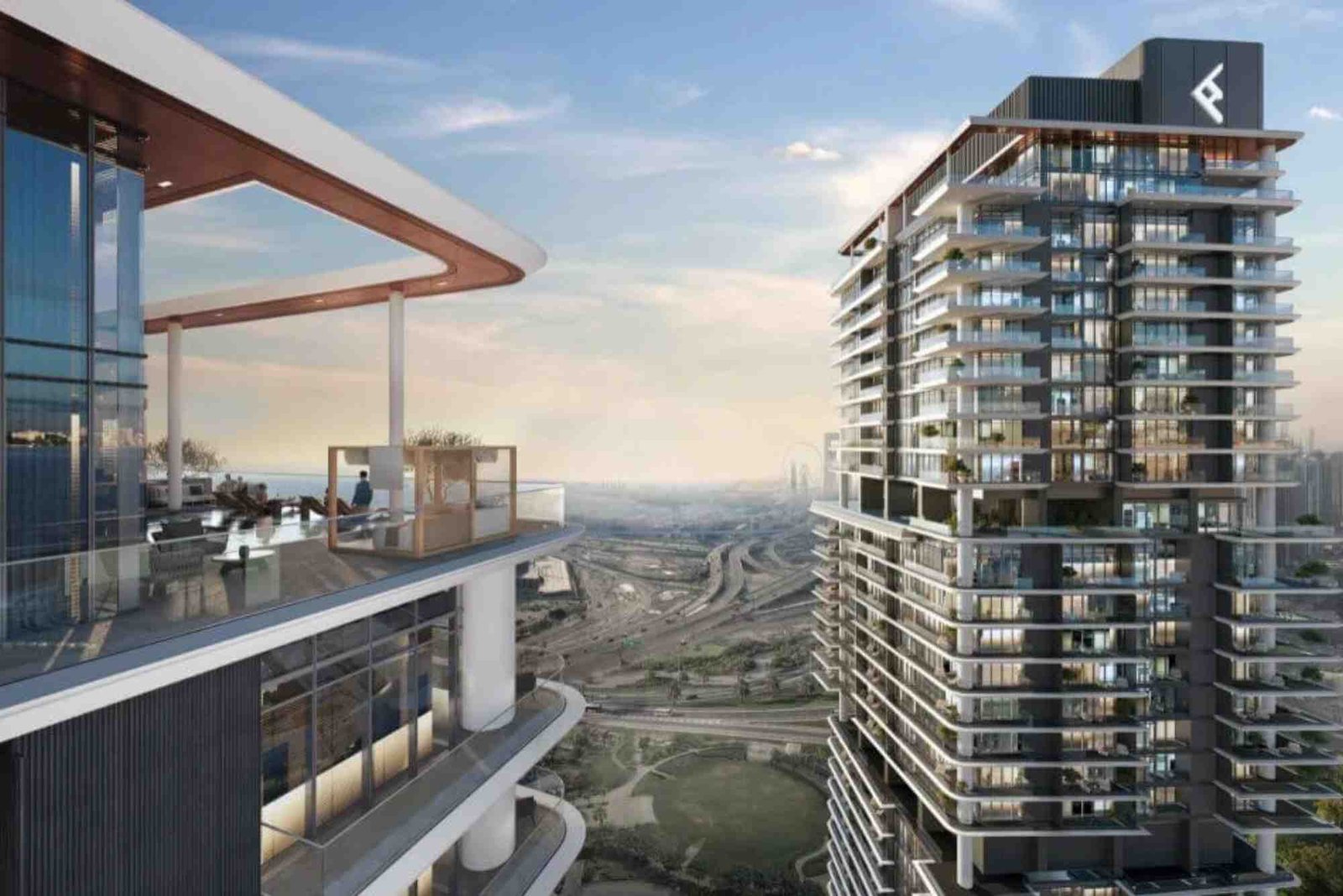

- Emaar Properties – Known for premium developments like Downtown Dubai and Dubai Marina.

- Damac Properties – Offers luxury residences and investment opportunities.

- Nakheel – Developer of Palm Jumeirah and other iconic projects.

- Sobha Realty – Specializes in high-end residential communities.

- Dubai Properties – Focuses on family-friendly communities and urban developments.

These companies have partnerships with major banks, making the mortgage process smoother for buyers.

Getting a mortgage for property in Dubai requires careful planning and understanding of the requirements. By assessing your financial position, choosing the right lender, and working with reputable real estate companies in dubai , you can secure the best mortgage deal. Whether you are a first-time buyer or an investor, following these steps will help you navigate the mortgage process with confidence.

If you’re ready to buy a property in Dubai, consult with real estate experts and mortgage brokers to make an informed decision. Investing in Dubai’s real estate market can be a rewarding experience with the right approach!